VA OCRP-102 2018-2025 free printable template

Show details

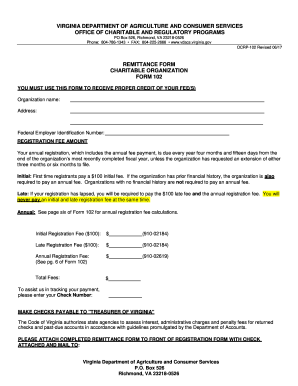

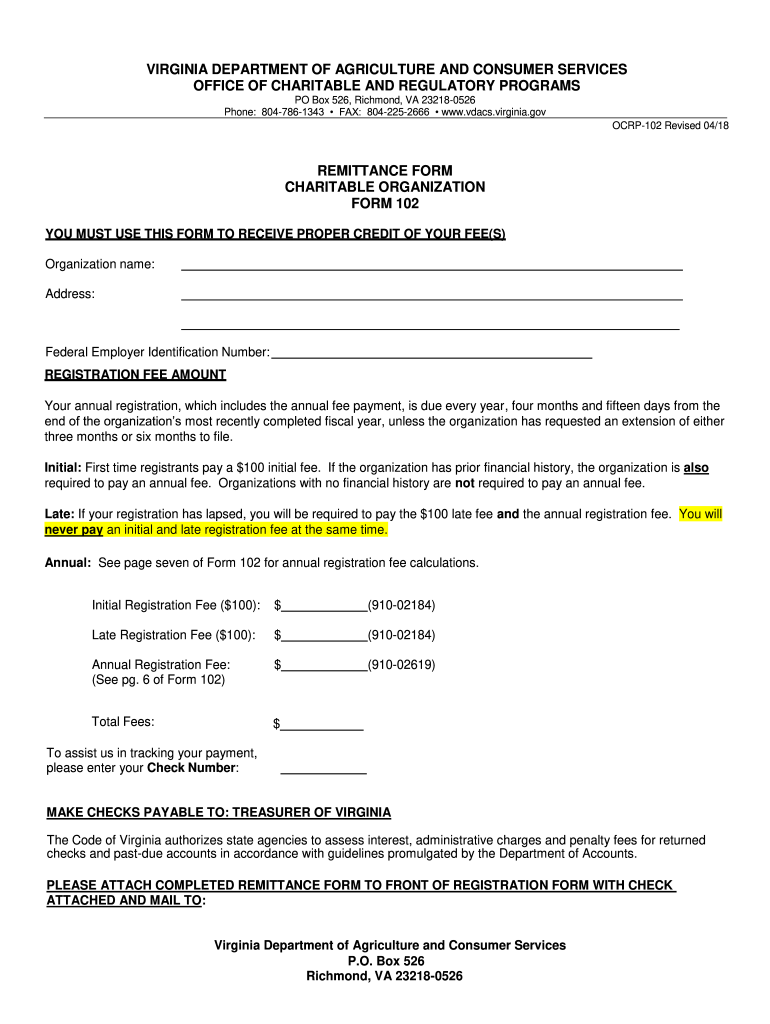

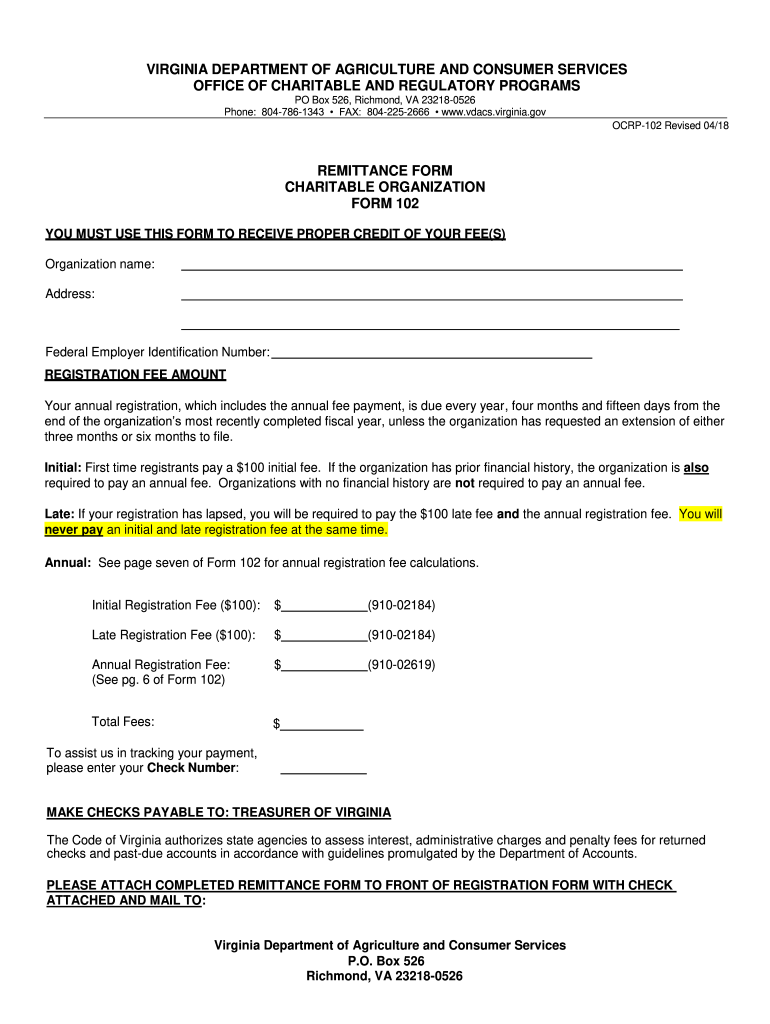

You will never pay an initial and late registration fee at the same time. Annual See page seven of Form 102 for annual registration fee calculations. Mailing address if different from primary address above 6. Other contact information Telephone including area code Internet URL Fax including area code The Official E-mail address entered above will be used for the notifications unless alternate email preference is indicated here Revised 04/18 Form 102 Page 2 7. Vdacs. virginia.gov OCRP-102...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign virginia charitable organization form

Edit your 102 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your va form 102 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vdacs form 102 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 102. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA OCRP-102 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out virginia form 102

How to fill out VA OCRP-102

01

Obtain the VA OCRP-102 form from the official VA website or your local VA office.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide your Social Security number and VA claim number, if applicable.

04

Complete the income information section by listing all sources of income and their amounts.

05

Fill out the expenses section with details about your monthly expenses, such as housing, utilities, and healthcare.

06

Sign and date the form at the designated section to certify that all information provided is true and complete.

07

Submit the completed form to the appropriate VA office, either electronically or by mail.

Who needs VA OCRP-102?

01

Veterans seeking financial assistance or benefits from the VA.

02

Dependents of veterans who may need to demonstrate income and expenses for benefit applications.

03

Individuals applying for VA vocational rehabilitation or employment services who need to provide financial information.

Fill

form 102 virginia

: Try Risk Free

People Also Ask about form 102 tax

How long does it take to process form I-102?

How Long Does It Take to Process Form I-102? The timeline from the date the USCIS receives your application until their decision to approve or deny your request can take anywhere from two to 15 months. Their processing times are subject to change, however, based on fluctuating caseloads.

What is form I-102 for?

I-102, Application for Replacement/Initial Nonimmigrant Arrival-Departure Document. Use this form if you are a nonimmigrant and need to apply for a new or replacement Form I-94 or Form I-95, Nonimmigrant Arrival-Departure Document.

How long does IOE I-129 take?

Processing of I-129 premium processing cases – 2 weeks. Processing of I-140 premium processing cases –2 weeks. Processing of I-129 non-premium processing cases –2 months.

How long does it take to process I-102?

How Long Does It Take to Process Form I-102? The timeline from the date the USCIS receives your application until their decision to approve or deny your request can take anywhere from two to 15 months. Their processing times are subject to change, however, based on fluctuating caseloads.

Do I need I-94 to apply for green card?

If you'd like to apply for change or extend nonimmigrant status or apply for green card through adjustment of status inside the United States in the future, you must submit a copy of I-94 together your application to prove you entered and/or stayed in the United States legally.

How long does it take for USCIS to process a petition?

Approximately 6 to 12 Months After Filing Most Form I-130 petitions for immediate relatives are approved within a 6 to 12 month time frame, but they can take longer in some cases. If you are in the United States and also filed an application to adjust status, USCIS will begin reviewing Form I-485 at this point.

How much is the fee for form I-102?

The filing fee for Form I-102 is $445. NOTE: The filing fee is not refundable, regardless of any action USCIS takes on this application. DO NOT MAIL CASH.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit virginia department of agriculture form 102 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your va 102 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I execute forms 102 online?

Filling out and eSigning vdacs virginia gov form 102 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the vdacs 102 pdf in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your virginia 102 revised and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is VA OCRP-102?

VA OCRP-102 is a form used by the Virginia Department of Veterans Services to report and document specific information related to benefits and services provided to veterans.

Who is required to file VA OCRP-102?

Individuals and organizations that provide services or benefits to veterans in Virginia are required to file VA OCRP-102.

How to fill out VA OCRP-102?

To fill out VA OCRP-102, follow the instructions provided with the form, ensuring that all required fields are completed accurately, and submit it to the designated agency.

What is the purpose of VA OCRP-102?

The purpose of VA OCRP-102 is to collect data and facilitate the reporting of services provided to veterans, enhancing the understanding of their needs and the effectiveness of programs.

What information must be reported on VA OCRP-102?

Information that must be reported on VA OCRP-102 includes the type of services provided, the number of veterans served, and specific demographic information about the veterans.

Fill out your VA OCRP-102 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Form 102 is not the form you're looking for?Search for another form here.

Keywords relevant to vdacs form download

Related to virginia form 102 instructions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.